I really hate talking about investments.

Not because it isn’t important; every financial plan needs an investment strategy that aligns with the goals of the plan.

The reason I hate talking about investments is because the default thought people have is, “How can I become rich by rolling the dice on an up-and-coming stock?”

This mentality is on the verge of crossing into the world of gambling. (I enjoy a good session at the blackjack or craps table as much as the next person, but this isn’t investing…)

There’s a better use of your time and/or money:

Focus your investing on something that can have a huge return for the money, time, and effort you put into it.

This is something for which you can have much more control over the outcome.

So, what is this investment that is supposed to be sooooo good?

Well… it’s YOU!

LIFETIME EARNINGS

You may have heard of the concept “Human Capital.” This is just a fancy way of saying that over your lifetime there is a certain amount of money you are going to earn. If you add all this money up, it represents your human capital.

For example: Assume you are 30 years old, plan to retire at 65, and are making $100k per year; with no raises, you’ll earn $3.5 Million over the course of your career. (35 Years X $100k = $3.5 Million) With typical salary raises, this number will grow.

That’s a pretty decent chunk of change!

But what if you can increase that number?

Let’s say you increase your annual salary just 10%. In this example, over a full career, that could mean upwards of $350,000 of increased earnings. And that doesn’t even include your ability to invest that money and grow it.

WAYS TO INVEST IN YOU

So what are some ways to invest in good old you?

The one everyone knows about is going to college. It has been heavily documented that the lifetime earnings of a college graduate far outweigh those of someone with just a High School diploma, or especially those who haven’t even made it through High School.

Other ways you can invest in yourself include:

- Getting advanced degrees in your industry.

- Attending workshops hosted by or paid for by your company.

- Obtaining advanced designations. In the finance industry there are a number of highly respected designations such as CFP, CFA, CIMA, CPA, etc.

- Starting a side business to boost your income.

- Better yet, start your own business and become self-employed!

- The idea is to find ways to make yourself more marketable and more valuable in your industry. This way you can command a higher salary and increase your “Human Capital.”

IMMEDIATE IMPACT!

Some of you are probably wondering, “How can I make an impact without having to go through some multi-year endeavor, like getting an MBA?”

The best way I know most people can make an immediate impact: Asking for a raise!

Most people aren’t thinking about this as a way to increase their wealth-building ability, but they should be.

In a study by payscale.com, only 37% of millennials had ever asked for a raise. But 43% of those who asked received the pay increase they were looking for.

Stated a different way:

Almost half of the people who are asking for raises get exactly what they want, but only about 1/3 of us are actually willing to ask.

As the saying goes, “If you don’t ask, the answer is always no.”

THE MATH

In my earlier example, I mentioned that a 10% boost in lifetime earnings would mean an additional $350,000 for that individual. But that is only part of the equation.

Companies tend to give annual salary increases across the company, usually to keep pace with inflation. So everyone might get a 2-3% pay boost each year.

If you were to negotiate a 10% jump in your salary, and then the next year your company gives a 3% boost to everyone, your boost will be on the original salary AND the additional increase you received from your raise.

Scenario 1: No Raise

- Beginning Salary: $100,000

- After Company-Wide 3% Boost: $103,000

Scenario 2: Negotiated 10% Raise

- Beginning Salary: $110,000

- After Company-Wide 3% Boost: $113,300

Let’s compare that $350,000 of potential increased human capital with other investments people often talk about.

Value For Average American Household (65 Years of age or older):

These numbers are for people in or near retirement. If you could add the kind of lifetime earnings we spoke about earlier, this could have a huge impact on your wealth.

YOUR ROADBLOCK TO WEALTH

So what is stopping you?

You don’t have to say it: Fear!

We all fear rejection in one form or other. This is why working in sales is so difficult for most people, or why you probably don’t like the thought of getting up on a stage to give a presentation. Most people are concerned about what others might think.

One of our biggest problems as humans is our ability to create stories in our head. I do this all the time. Some random topic swan-dives into my brain, and I proceed to go through a winding maze of potential conversations, issues, and outcomes.

Many of these things could happen, but nothing has actually happened yet. I have to force myself to reset back to square one so I’m not working with emotions I created in my made-up scenario.

It’s absolutely fine to brainstorm how things could go, but don’t let your brain get in the way by making you think the conversation has already happened before it actually does.

Heck, you could walk in to ask your manager for a raise, and they might have actually already been thinking about it… because you DO deserve it. (If that’s true, of course.)

Don’t convince yourself that your manager will say “no” before you even give them the chance.

Fear can only stop you from getting what you deserve if you let it.

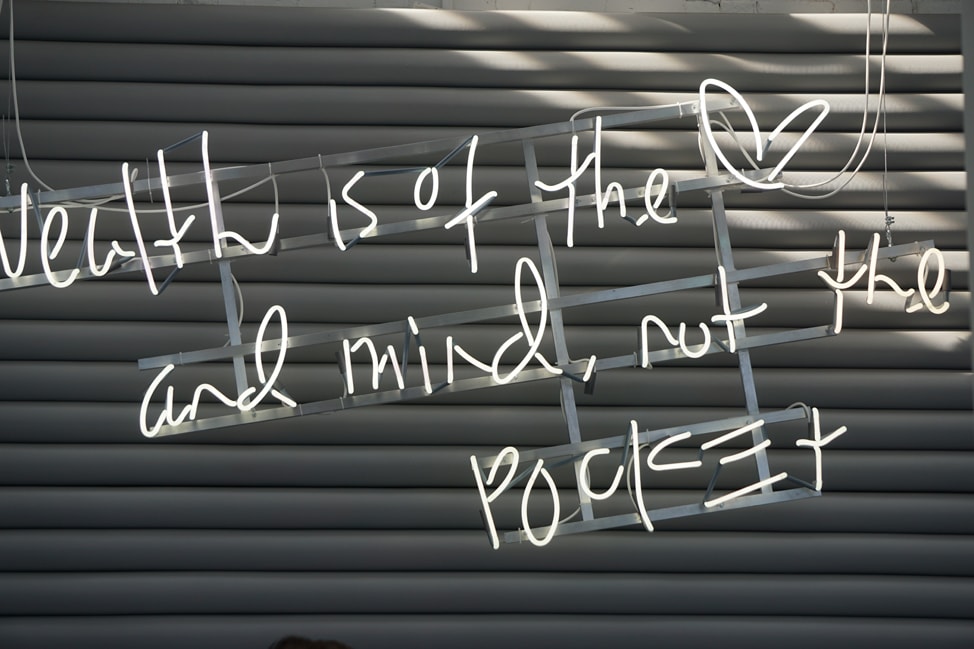

“Everything you’ve ever wanted is on the other side of fear.” – George Addair

PUTTING A BOW ON IT

I hope this post has inspired you to look at investing in a different light. There are many ways to invest and build wealth; you don’t have to follow the typical path.

Be on the lookout for a future post about how to negotiate salary increases!